How is the NHS funded?

NHS funding is quite simple. We will now explain how the NHS is funded, the amount (and pattern over time) – and what it is spent on.

The NHS is funded mainly from general taxation supplemented by your National Insurance Contributions (NICs). That is the short answer.

In April 2003, National Insurance Contributions were increased to boost NHS funding (see graph below). This increased the share of NHS funding that comes from National Insurance Contributions; but general taxation still accounts for the vast majority of NHS funding.

In addition, a small proportion of NHS funding comes from patient charges. These include charges for prescriptions and dental treatment, first introduced in the early 1950s.

In 2019/20, income from patient fees and charges for prescriptions and dental care was £1.5 billion, or 1.1 per cent of the total Department of Health and Social Care (DHSC) budget.

Individual NHS organisations – such as hospital trusts – can generate additional income, for example, through parking charges, land sales and treating private patients.

The level of NHS funding in a given year is set by central government through the Spending Review process. This process estimates how much income the NHS will receive from sources such as user charges, National Insurance and general taxation.

If National Insurance or patient charges raise less funding for the NHS than originally estimated, funds from general taxation are used to ensure the NHS receives the level of funding it was originally allocated.

How much does the NHS cost?

In other words, it costs alot (alot) and is about 10% of your taxes (vs say 2% on defence).

What is NHS funding spent on?

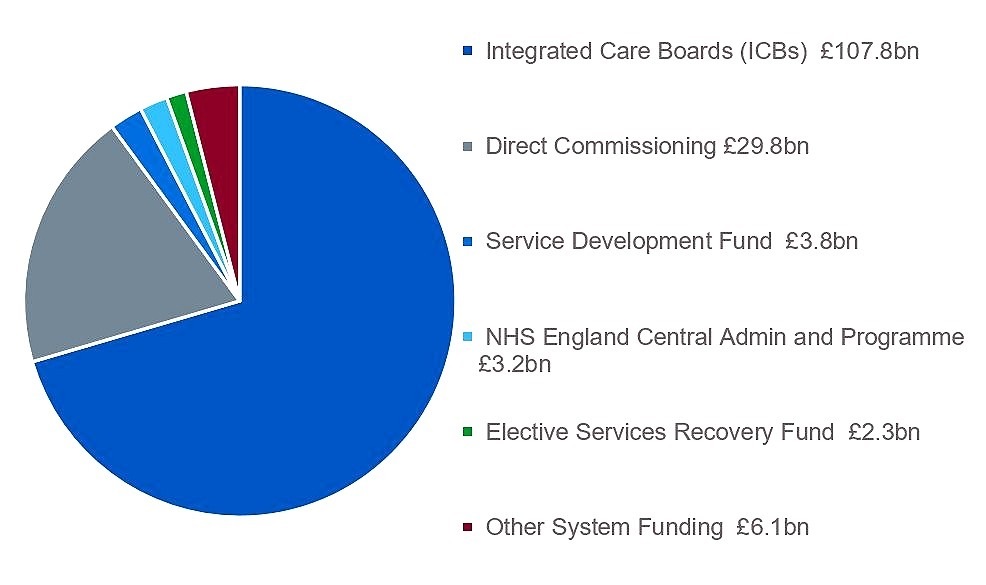

This pie chart is for England.

Direct commissioning includes Specialised Commissioning, which is for rare and expensive diseases and their treatment – such as kidney dialysis, transplants, cardiac and neurosurgery.

Summary

We have explained how is the NHS funded. We hope it is clearer now.